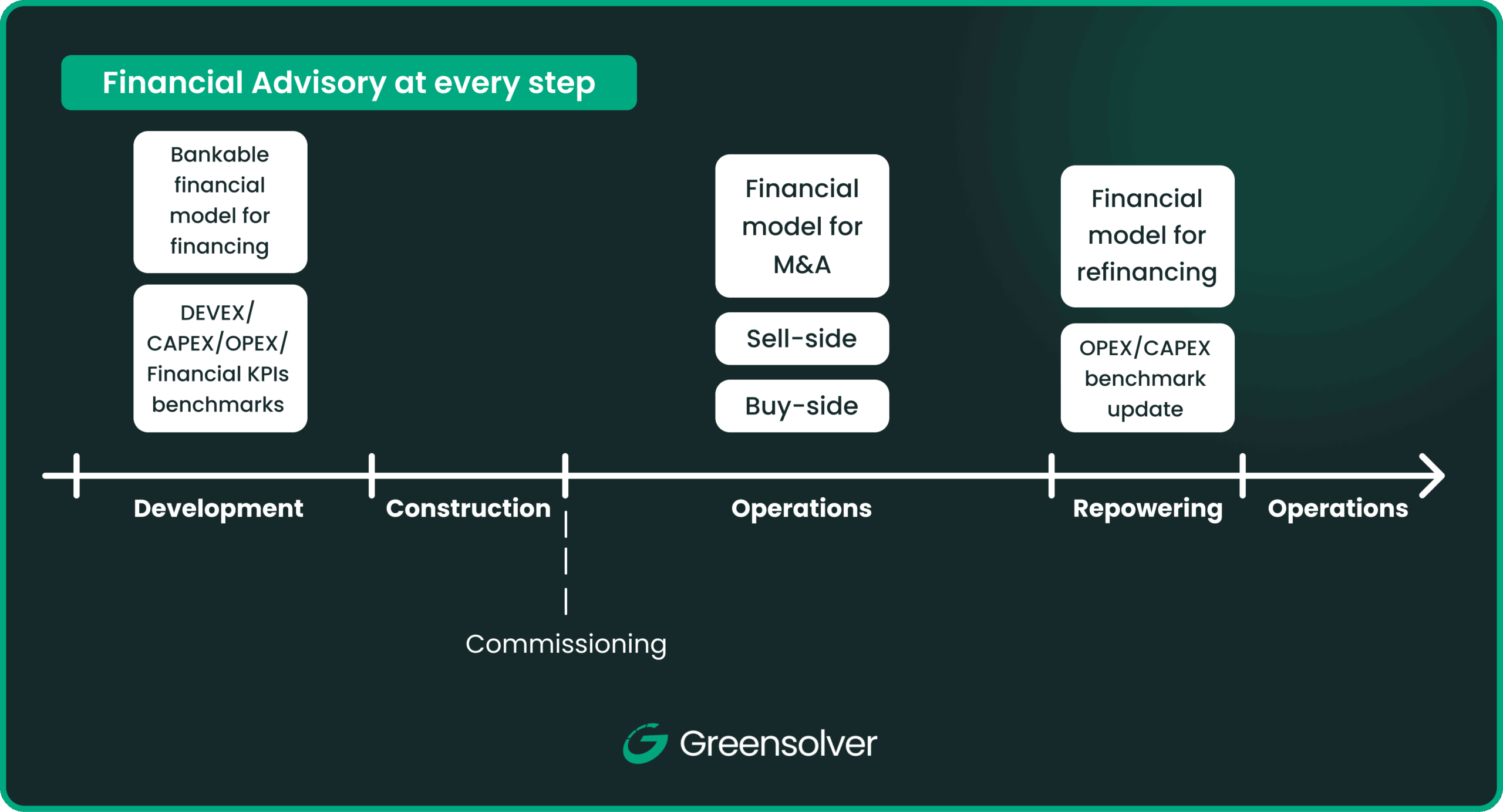

Financial advisory for Project Financing and M&A transactions

A reliable financial model is essential for any renewable energy investment. At Greensolver, we develop business plans that accurately reflect the technical, economic and regulatory realities of each project. By integrating validated technical performance, realistic CAPEX/OPEX assumptions, market benchmarks and revenue frameworks, we provide clear visibility on project profitability. Our independent approach ensures credibility, transparency and full alignment with the expectations of investors, lenders and transaction partners.

Premium approach for Bankable Outputs

Tools

We rely on proprietary financial models and internal data of more than 62 GW of solar, wind and storage projects built over 15+ years of European market experience. These tools enable multi-scenario analysis, debt-structuring simulations, sensitivity modelling and revenue-stacking assessments for renewable projecst. With integrated long-term forecasting for DCF valuations, our software environment provides a robust, data-driven foundation for evaluating project economics.

Methodology

Our methodology is grounded in IFRS principles and recognised market standards, ensuring that every financial output is consistent, transparent and aligned with lender and auditor expectations. As an independent advisor and using our chartered accountants, we apply a structured process that links technical inputs to financial results. This ensures bankable analyses trusted by investors, lenders and transaction partners.

Reports

Example of Financial Model outputs

- IRR, NPV and payback period

- Annual Cash Flows

- Enterprise Value Metrics

- Debt sizing

- Revenue Stacking for BESS

- BESS sizing for Hybrid

A Proven Track Record in Financial Advisory