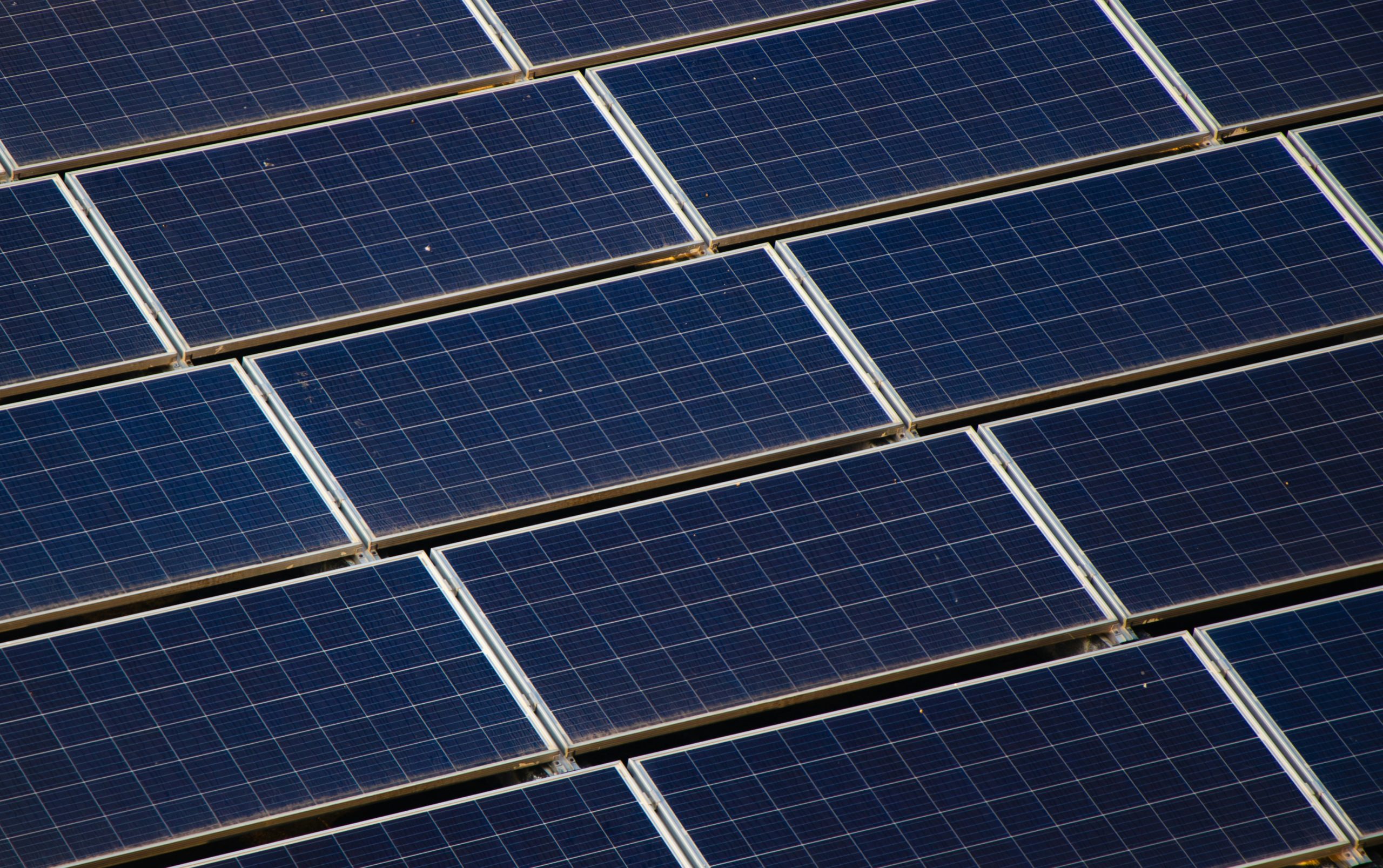

Grid Availability and Curtailment: The Hidden Drivers of Solar Asset Performance

Grid Availability and Curtailment: The Hidden Drivers of Solar Asset Performance

As solar portfolios mature, it’s becoming clear that asset performance isn’t just about irradiation or inverter efficiency — it’s also about the grid itself.

While metrics like Performance Ratio (PR) and system availability dominate most dashboards, two critical — and often underestimated — KPIs can make or break a plant’s returns: grid availability and curtailment.

– Grid Availability

This measures how often your plant can actually deliver energy to the grid. Transformer outages, voltage fluctuations, or DSO maintenance can all interrupt export — regardless of how well your system is performing technically.

For asset managers, tracking this downtime is essential to distinguish between operational underperformance and external limitations.

– Curtailment

Curtailment happens when grid operators limit energy exports to maintain stability — or when market conditions, such as negative prices, make generation uneconomic.

In 2025, several European markets saw negative electricity prices during sunny, low-demand periods. Understanding whether these limitations are grid-enforced or market-driven is key to managing both technical reporting and financial exposure.

Why These KPIs Matter

If we ignore grid-related losses, we risk misjudging asset performance. A plant might seem to “underperform” when, in fact, it’s the grid or the market holding it back.

By clearly separating technical availability, grid availability, and market-driven constraints, asset managers can provide investors with a more transparent view of real performance and revenue attribution.

Taking Action

- Integrate grid data into performance reports — Correlate SCADA logs with DSO events and track external downtime separately.

- Quantify curtailment events — Classify them by cause and duration to support claims or anticipate future risks.

- Leverage predictive analytics — Use historical data to forecast curtailment patterns and refine financial models.

Conclusion

As solar penetration increases across Europe, these grid-related KPIs are becoming central to how we evaluate, report, and optimize solar assets.

Recognizing them isn’t just about accuracy — it’s about protecting value and building investor trust in an increasingly dynamic market.

Written by Natasha Reveilhac – Asset Manager Solar