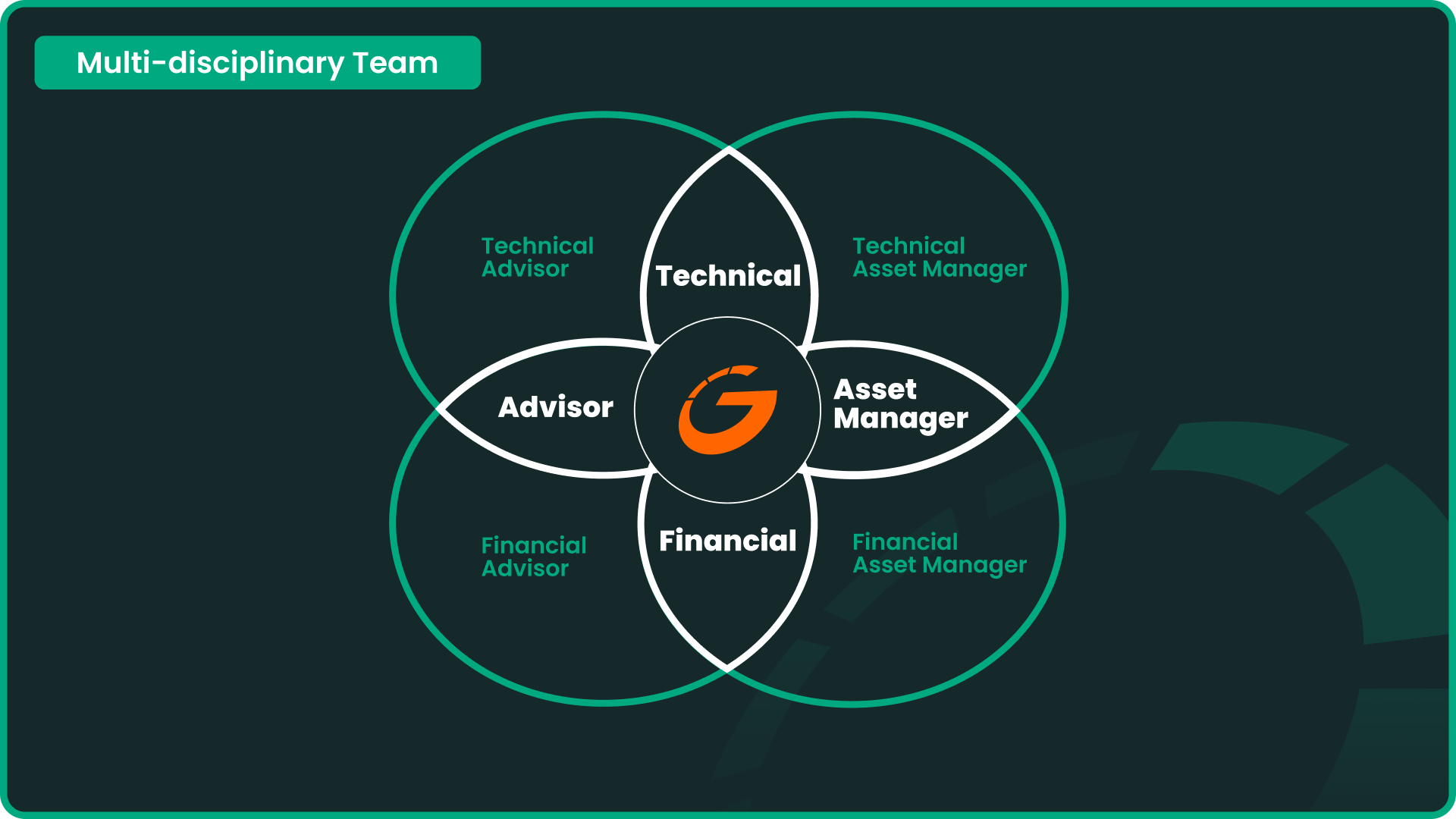

Technical Insight & Financial Oversight

We combine technical advisors, engineers, HSE specialists, financial analysts, accountants, as well as technical and financial asset managers within one integrated organisation.

This creates two essential synergies:

TECHNICAL × FINANCIAL SYNERGY: Real site data sharpens our financial models, while accounting and contractual expertise supports better technical decisions. The result: realistic assumptions, stronger bankability and a precise view of risks and lifecycle costs.

ADVISORY × ASSET MANAGEMENT SYNERGY: Operational insights strengthen our due diligence work, while advisory benchmarks and methodologies enhance day-to-day asset optimisation. This continuity ensures consistency, performance and resilience throughout the asset lifecycle.

By combining these capabilities, Greensolver provides a true 360° understanding of technical, financial and operational value.

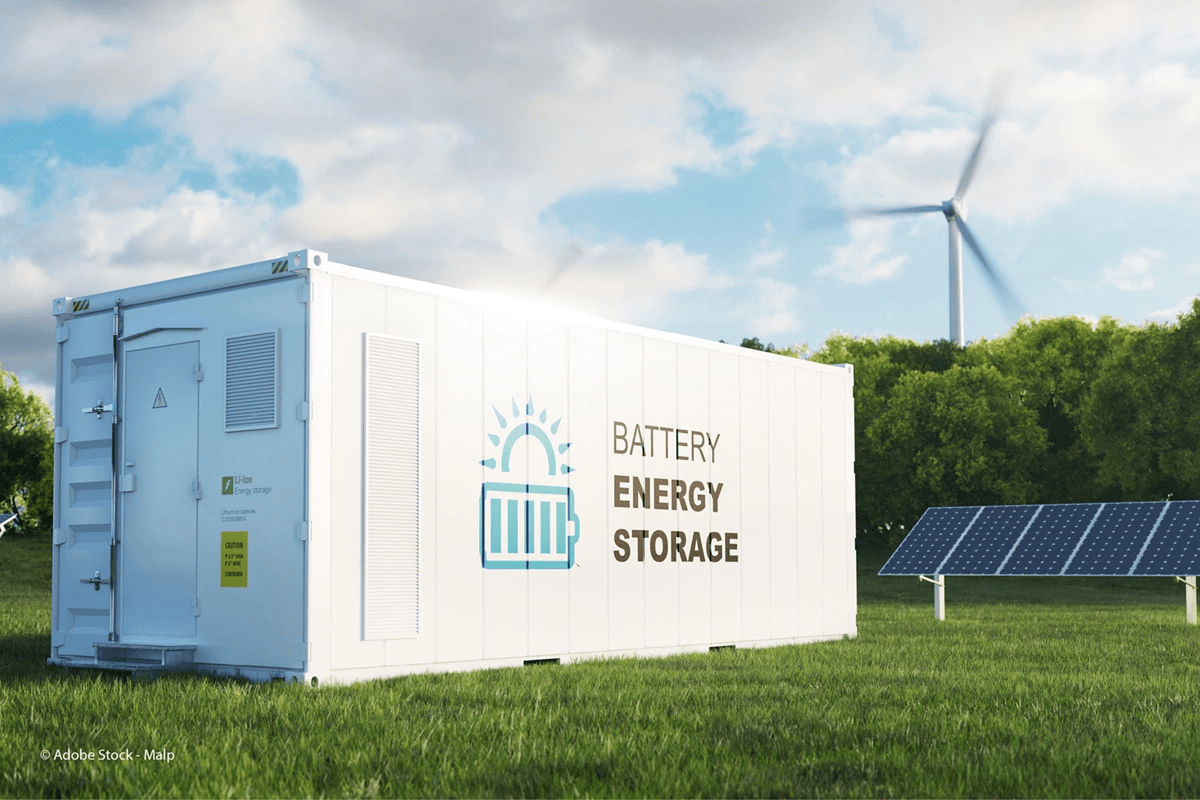

Wind, Solar, BESS: Supporting Standalone, Mixed and Hybrid Portfolios

Greensolver combines deep expertise in wind, solar and BESS within a single integrated team, offering a unified understanding of how these technologies interact across mixed portfolios. This multi-technology perspective is essential as hybrid assets become increasingly common and require consistent modelling of yield, availability, cycling behaviour, curtailments and grid constraints. Our strong knowledge of Tier-1 manufacturers and emerging technologies further strengthens equipment selection, performance assessments and risk evaluation. By leveraging shared insights across technologies, Greensolver delivers reliable solutions and support for both standalone assets and complex hybrid configurations.

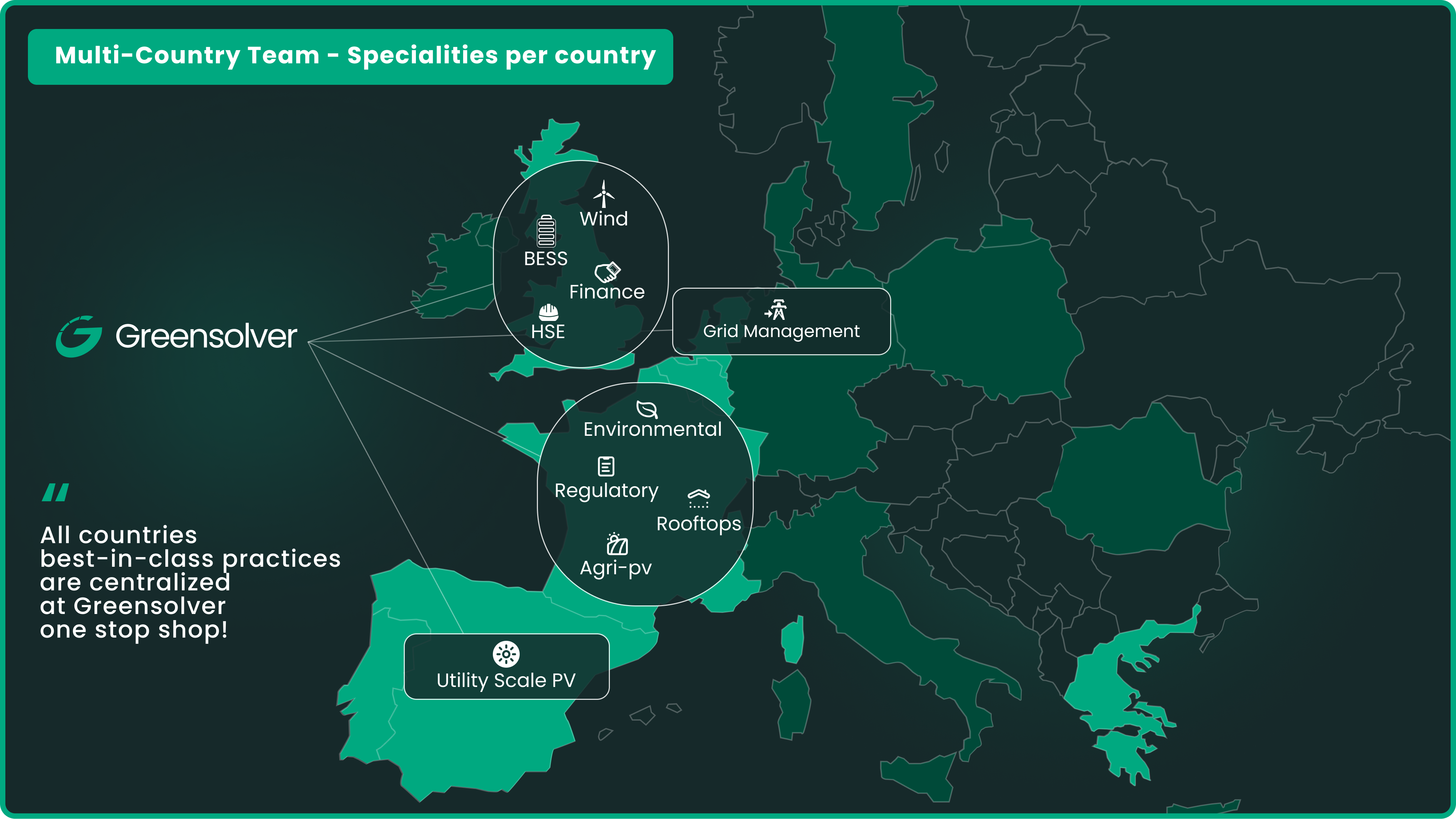

Local Expertise, European Best Practice

Greensolver operates across Europe with local teams in France, Belgium, the UK, Spain, Portugal, Greece, the Netherlands and Switzerland, supported by a trusted partner network in Poland, Germany, Romania, Italy, Sweden, Norway, Finland and Estonia. This footprint allows us to advise and manage our European portfolios with consistent quality.

We merge each country’s strengths into one unified operational and advisory approach. The UK brings market-leading wind, BESS and financial expertise. Spain delivers best-in-class utility-scale solar know-how. France provides deep environmental, regulatory, rooftops PV and agri-PV expertise. By blending local insight with continent-wide best practice, Greensolver ensures high-quality Advisory and Asset Management for mixed portfolios across Europe.

Proven Satisfaction. Real Results.

92.5%

Global Satisfaction90%

Asset Management95%

Due DiligenceProven Track Record

Technical Due Diligence : +55GW

Greensolver has delivered more than 55 GW of technical due diligence across Europe, covering 30 GW of solar PV, 20 GW of onshore wind, and 5 GW of BESS. (This includes 20 GW of financial due diligence performed across all technologies). This track record reflects Two decades of in-depth project analysis, risk identification, modelling validation and bankability assessments across diverse markets, technologies and transaction contexts.

Asset Management : +7GW

Greensolver has managed more than 7 GW of renewable assets across Europe, including 3 GW of solar PV, 3 GW of onshore wind, and 1 GW of BESS. This track record reflects two decades of hands-on operational experience, contractor supervision, performance optimisation and regulatory compliance across diverse technologies, configurations and markets.

20 Years of Renewable Energy Expertise

Founded in 2008, Greensolver has evolved from a technical advisor into a fully integrated European consultancy. With nearly two decades of hands-on experience across wind, solar and storage, we combine engineering excellence and financial reliability. Our teams support lenders, investors, developers, producers and asset owners across the entire asset lifecycle — helping shape a more resilient, low-carbon energy future.