Finance & Commercial Asset Management: Beyond Accounting, Towards Long-Term ValueFinance & Commercial Asset Management: Beyond Accounting, Towards Long-Term Value

Beyond Accounting – Unlocking Long-Term Value in Renewables

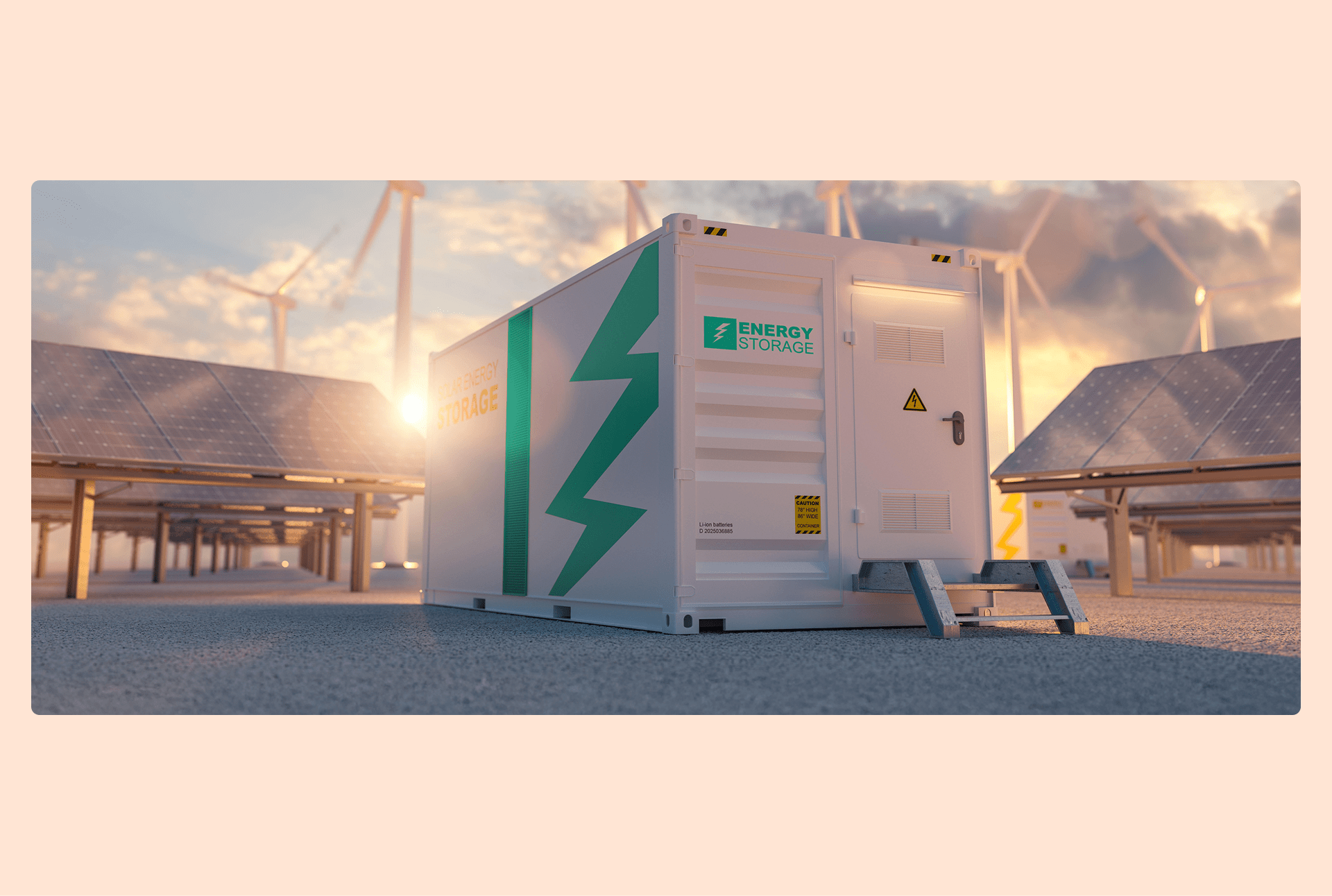

Managing renewable energy assets is no longer just about keeping the books.

As the sector matures, financial and commercial performance is as critical as technical operations.

At Greensolver, our Finance & Commercial Asset Management team has a clear mission:

Maximize the long-term value of renewable portfolios by combining financial expertise with technical insight.

The Challenge

Renewable assets are complex.

Structured debt, strict audits, volatile cash flows, and multiple stakeholders — banks, investors, utilities, tax authorities — all bring unique requirements.

If unmanaged, this complexity leads to hidden risks, inefficiencies, and weaker returns.

Our Approach

We treat every asset like a business in its own right.

Our integrated services include:

- Budgets, reporting & profitability tracking

- Debt & cash flow management

- Audit preparation & compliance

- Contract & invoicing management

- Smooth stakeholder communication

Result: clarity, efficiency, and proactive decisions — freeing investors to focus on growth instead of administration.

Why Greensolver?

- 100% renewable focus – solar, wind, storage, EV charging

- Pan-European expertise – navigating multiple markets & frameworks

- Finance + technical integration – working hand-in-hand with engineers to optimize long-term performance

Trusted by Leaders

Industry pioneers like Impax, Schroders Greencoat, Romande Energie, Demeter, Crédit Mutuel, and SMEG Energy already rely on us to manage their portfolios with transparency and precision.

The Benefits for Investors

- Stable, predictable cash flows

- Zero-surprise audits & compliance

- Improved visibility & efficiency

- More time to focus on growth and innovation

At Greensolver, finance is not just a back-office function.

It’s a strategic driver of the energy transition.

We help clients unlock the full potential of their renewable assets — delivering reliable returns while accelerating Europe’s shift to clean energy.

Greensolver Finance & Commercial Asset Management: not just numbers, but trust, resilience, and lasting value.

Written by Antonio Delerue Mendes