What Profitability Can Be Expected from an Agrivoltaic Project?

What Profitability Can Be Expected from an Agrivoltaic Project?

What Profitability Can Be Expected from an Agrivoltaic Project?

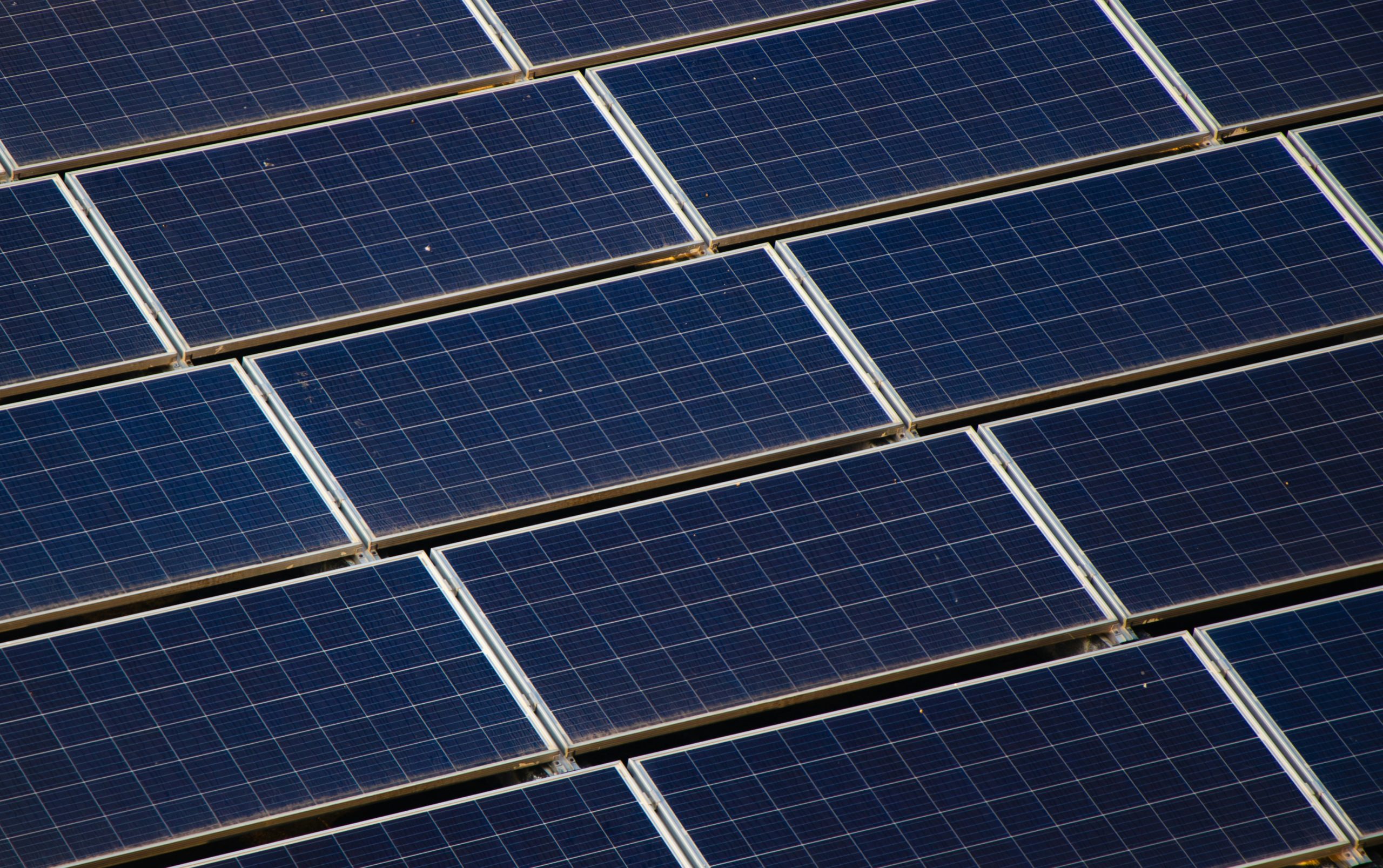

Agrivoltaics is emerging as a forward-looking solution, combining agricultural production with solar energy generation. With the April 8, 2024 decree, implementing the APER law (Acceleration of Renewable Energy Production), a precise legal framework has been established to regulate this practice in France. Today, agrivoltaic projects stand at the crossroads of two major challenges: the energy transition and agricultural resilience. What level of profitability can truly be expected from such a project?

Agrivoltaics is based on a hybrid economic model, combining revenue from agricultural production with income generated from electricity sales. Photovoltaic panels produce electricity, which benefits from guaranteed purchase prices through Power Purchase Agreements (PPAs) for the first 15–20 years of a solar farm’s operation. For a standard project commissioned in early 2026, these tariffs currently range between €63 and €70/MWh*. At the same time, farmers can benefit from higher crop yields under certain conditions. When crops are optimized, solar panels can enhance productivity, particularly in vineyards and certain cereal crops (wheat, barley), which benefit from drought protection and better water management.

For agrivoltaic livestock farming projects, two primary models stand out: sheep farming and cattle farming. Currently, sheep-based projects are the most widespread due to lower initial investment costs, particularly because the height requirements for solar panels are lower compared to cattle projects, allowing for lighter structures. On average, sheep farming projects have a CAPEX of approximately €850k/MW, which is 9% lower than cattle-based projects. Additionally, sheep naturally graze between the panels, contributing to land maintenance. The light shading from the panels encourages grass growth, which is then consumed by the livestock.

Financial Modelling conducted by Greensolver shows that an investor can expect an average Internal Rate of Return (IRR) between 7% and 12% for a sheep-based project, 6% and 10% for a crop-based project, and 6% and 9% for a cattle-based project. On average, Greensolver estimates that the expected IRR for investors is around 8.5%. In France, traditional solar farm projects are becoming scarcer, while agrivoltaic projects are expanding, integrating both the energy and agricultural markets.

However, agrivoltaic projects in France still face several challenges. A major issue remains co-responsibility between farmers and energy providers. The tenant farming status (fermage), which guarantees farmers autonomy in managing their land, can sometimes conflict with the obligations of energy producers, who need to secure their investment and control land use from the outset. Balancing agricultural and energy interests still requires regulatory and contractual adjustments.

Although the sector is still developing, France has set clear ambitions for solar energy expansion. By 2045, the country aims to reach an installed capacity of 75 to 100 GW of photovoltaic power. Alongside Germany, France is one of the most advanced nations in integrating agrivoltaics as a key driver for both the energy transition and agricultural resilience.

Greensolver’s teams support you in defining and developing your agrivoltaic project, from market studies to asset management, while considering regulatory changes and industry challenges.

*(for further information, reach out GRS team)

Written by Antra Ramboarison